Empowering Your Financial Journey

Hi Team,

Today we are exploring the wisdom shared by Morgan Housel on his work "The Psychology of Money". We will go through some of the important topics the book discusses & maybe how we can use this knowledge practically.

Personally I read this one because the title touched me, I had a feeling that there is something that did not stand right between me & money but he came with ideas that could help me change that with results.

It has been working lately, and I wrote this to share with you how I understood the book and how I am using its advice. Let's get into it.

Core Principles & Practical Steps:

Spend less than you earn

Meaning: Financial freedom begins with the discipline of living below your means. By controlling spending, you can save and invest the difference.

Pain of ignoring: Overspending leads to debt, stress, and limited ability to invest or save, trapping you in a cycle of financial insecurity.

Gain of following: You’ll have surplus funds for savings, investments, and opportunities, building a strong financial foundation.

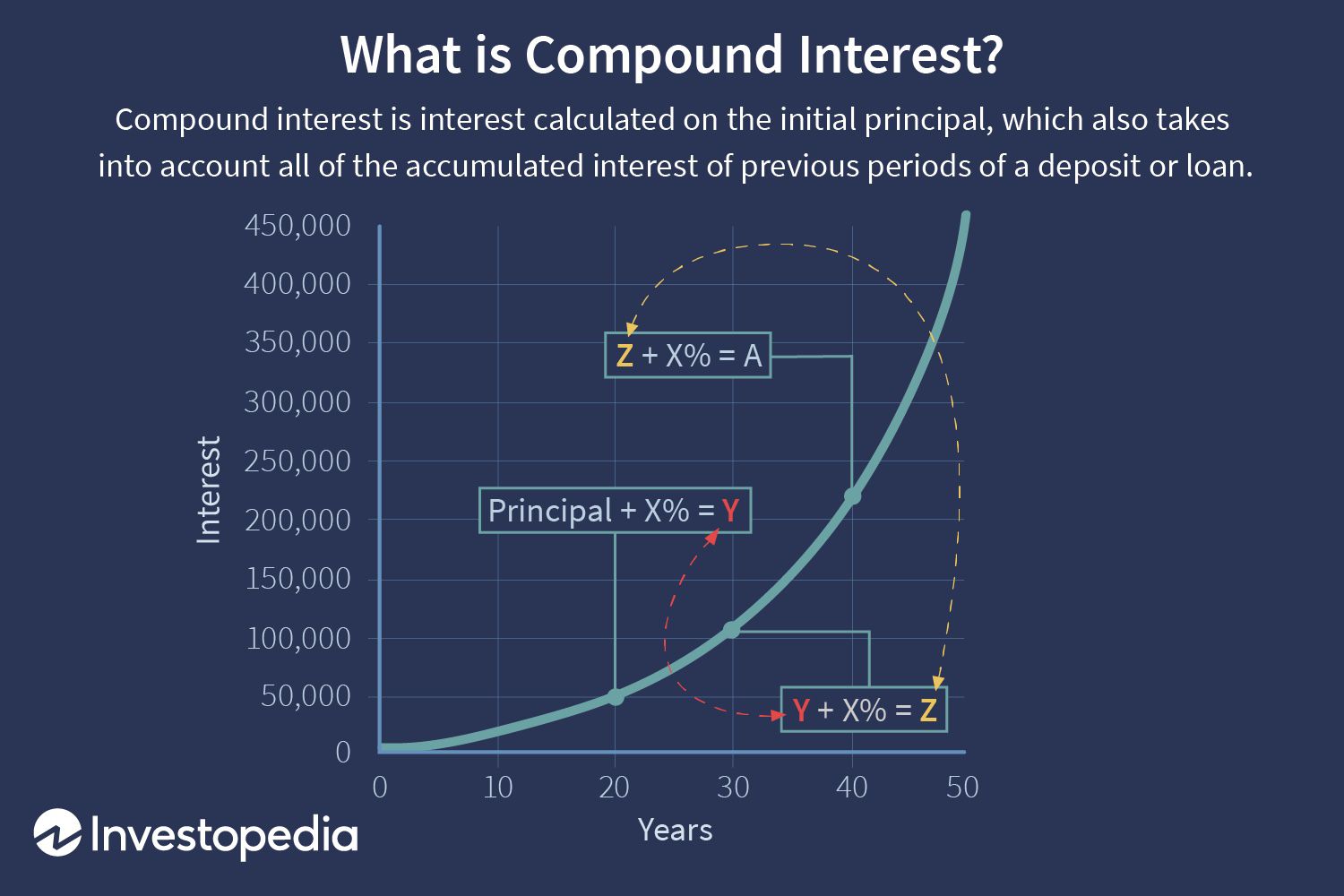

Time is your ally

Meaning: The power of compounding increases wealth over time. Start investing early to maximize this benefit.

Pain of ignoring: Delaying investments reduces the compounding effect, making it harder to achieve long-term financial goals.

Gain of following: Early and consistent investments can grow exponentially, leading to significant wealth accumulation over time.

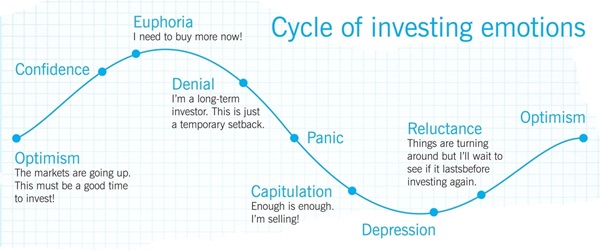

Stay humble & embrace uncertainty

Meaning: The future is unpredictable; acknowledge that no one can foresee market movements perfectly. Adopt a long-term perspective.

Pain of ignoring: Overconfidence can lead to risky investments, emotional decisions, and potential losses.

Gain of following: By accepting uncertainty and focusing on long-term goals, you reduce stress and increase the likelihood of achieving financial freedom.

Avoid lifestyle inflation

Meaning: Resist the temptation to increase spending as your income grows. Keep your expenses stable while your savings grow.

Pain of ignoring: Lifestyle inflation can erode financial gains, leading to a constant need for more income just to maintain your lifestyle.

Gain of following: Keeping lifestyle inflation in check ensures more resources are directed towards investments and savings, accelerating your path to financial freedom.

Control your ego

Meaning: Avoid making financial decisions based on what others are doing or to impress others. Focus on your own goals.

Pain of ignoring: Ego-driven decisions can lead to unnecessary risks, overspending, and financial instability.

Gain of following: By making decisions aligned with your personal goals, you build a more secure and fulfilling financial life.

Focus on long-term wealth building

Meaning: Invest with a long-term perspective, and resist the urge to chase quick profits.

Pain of ignoring: Short-term thinking often leads to poor decisions, higher taxes, and reduced returns.

Gain of following: Long-term investing maximizes returns, reduces risks, and helps build sustainable wealth.

Practical steps for the Team:

Create an emergency fund

Purpose: Protect against unexpected expenses e.g. job loss, medical emergencies.

Goal: Save 3-6 months’ worth of living expenses in a high-yield savings account.

Process:

Calculate monthly expenses e.g. you need a minimum of R20 000 monthly.

Set up automatic transfers to a dedicated savings account. It does not have to be saving the entire fund but what you can afford to save each month.

Prioritize building this fund before other investments & starting small, not trying to do too much saving at once.

Develop an Investment Strategy

Step 1: Set clear goals

Define specific, measurable financial goals e.g. retirement, home purchase).

Define how much enough money is for you e.g. just 40 000 because I want enough to live monthly & also save & invest still being comfortable.

Step 2: Diversify investments

- Spread investments across various assets e.g. stocks, bonds, ETFs, real estate.

Step 3: Choose low-cost index funds

- Invest in broad-market index funds or ETFs for diversification and lower fees.

Step 4: Regular contributions

- Invest a fixed amount monthly, regardless of market conditions, to benefit from dollar-cost averaging.

Step 5: Review and adjust

- Annually review your portfolio and rebalance as needed to stay aligned with your goals.

Conclusion:

Teaching these principles to your team and also using them will help you personally & also in the team me and you share. It is important to me that the people in my life make as much as they can & also have the financial empowerment they need to see themselves moving forward in their lives with pride about what they can achieve with money.